Focus On Growing Your Business

Trust The Accounting To Us

Our bookkeeping services cater to businesses across various industries. We provide daily, weekly, and monthly services tailored to your requirements, including bookkeeping/accounting, tax services, and business consulting.

Welcome To Ultra Tax Pro

We Are Calculating The Best Opportunities For You

Since 2011, our advisors at Ultra Tax Pro have served Florida businesses and individuals with a mission of providing exceptional service to our clients with complete integrity and the highest levels of technical competencies

Learn from customer feedback

Professional Team

High Savings Potential

24/7 customer support

Rod Hill

– Founder Ultra Tax Pro

500 +

Happy Clients

1100+

Projects Completed

13+

Years Of Experience

10+

Team Members

Our Services

What Service We Offer

Why should you work with us at Ultra Tax Pro? When you outsource your accounting services to our Florida firm you can enjoy the following benefits.

Personal Taxes

We can file all 1040 forms and schedules to help you maximize your return

Bookkeeping

We perform monthly account reconciliations, Quarterly Tax Filings, Financial Reporting

Business Taxes

We handle all business returns such as C Corps, S Corps, Non Profits and Partnership Returns

Payroll & Salary

We Handle weekly/bi-weekly payrolls, quarterly tax filings, year end statements

Outsourcing

we can help you get your books on the track to success. Let us revolutionize your bookkeeping!

Compliance Monitoring

Our Services let you stay on top of compliance tasks and filing dates, so you can focus on running your business.

Still Confused About Our Features? Get A Consultation

CHOOSE YOUR PERFECT PLAN FOR YOUR BUSINESS

Select the plan that best fits your needs and seamlessly adapts to support your future growth.

Silver

$299/mo

50 Total Max Transactions

Bank/credit card reconcilations

Quarterly Reports

Email Support

Quickbooks Online Subscription NOT included

$150 Setup Fee

Gold

$449/mo

300 Total Max Transactions

All Features of Silver Plan

Monthly Management Reports

Email and Phone Support

Quickbooks Online Subscription Not included

$150 Setup Fee

Platinum

$699/mo

500 Total Max Transactions

All Features of Gold Plan

AR or AP administration included

Email and Phone Support

Quickbooks Online Subscription Not included

$150 Setup Fee Waived

STILL NOT SURE?

Frequently Asked Questions

What is bookkeeping, and why is it essential for small businesses?

Bookkeeping is the process of keeping a record of every single financial transaction in your business. Transactions include receiving payment from your customers, paying your company’s bills, and other company expenses.It’s an essential small business function because all businesses need to know how much money they are bringing in, how much they are paying and what their profit is regularly. Without bookkeeping, you may have no idea how much profit you make daily, week to week, or month to month. And without profit? You can’t stay in business.

What are the common bookkeeping mistakes that small business owners should avoid?Question 2: What do you lorem ipsum?

The most common bookkeeping mistakes small businesses make are poor record-keeping and not reconciling accounts. Both make your business vulnerable to costly mistakes. They can also lead to a lack of accurate knowledge about your cash flow and profits and inaccurate financial statements. These are dangerous to your business because they can lead you to overspend or make poor decisions in the short term and to your business simply not being profitable in the long term.In addition, poor record-keeping can cause your tax filings and payments to be inaccurate, which can lead to fines and penalties.There’s one more common bookkeeping mistake, too — and that’s trying to do it yourself. Many small business owners assume that bookkeeping is simple and easy to manage. In fact, even simple individual bookkeeping functions can end up being a drain on your time and lead to frustration. Bookkeeping is also complicated enough that it’s easy to make mistakes. It’s better to hire a third-party service provider or bookkeeper than to spend way too much time on bookkeeping tasks and run the risk of error. If you’re looking for a cost-effective, all-in-one service,

What’s the difference between bookkeeper and accountant?

A bookkeeper is the one who keeps, records, and gathers financial data, while an accountant summarizes, interprets and communicates this data for financial decisions. The two roles are very similar, but still very different.While an accountant can do bookkeeping tasks (but usually don’t), they are better suited to consulting work, such as preparing your financial reports and helping you understand the financial impact of your previous (and upcoming) decisions.

Should I outsource my bookkeeping?

Yes, but it also depends on how much you’d like to micromanage.If you like having a tight rein over your company’s finances, being your own bookkeeper might work for you. However, our general recommendation is to outsource as it saves your time, money, and energy. Hiring a professional bookkeeper or accountant is always the better choice, as it can save you from making mistakes that could eventually cost you a lot.

Get In Touch

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

904-479-1063

Email & Address

Email: [email protected]

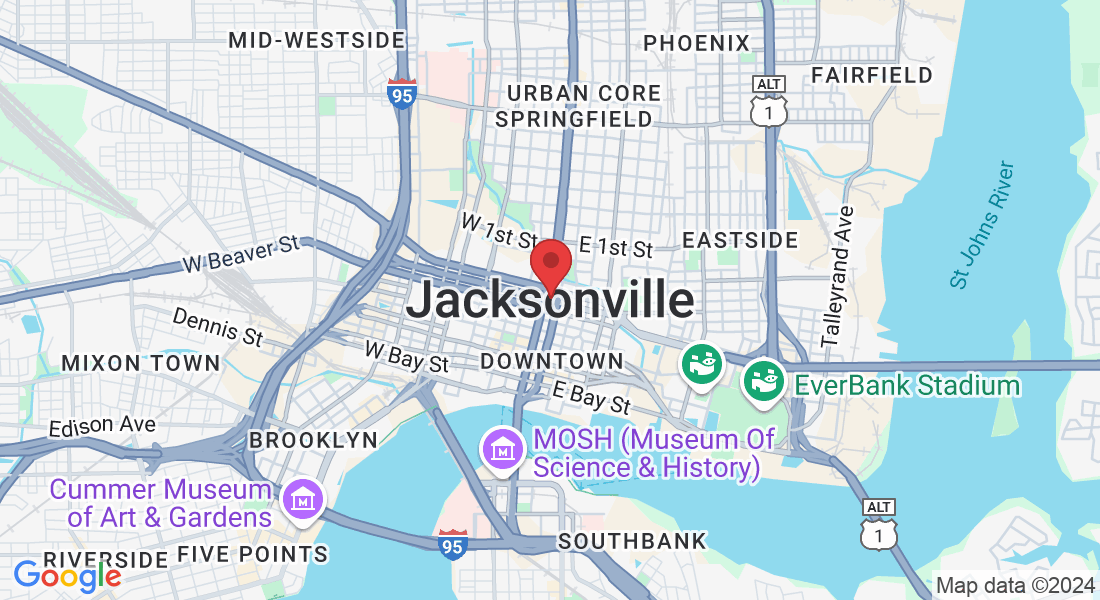

Address

Office: 221 N Hogan St. #392

Jacksonville, Florida 32202